ETAs: an increasingly popular route to business ownership

A growing number of aspiring entrepreneurs are becoming first-time CEOs by buying and scaling existing businesses. Instead of building a startup from scratch, the entrepreneurship through acquisition (ETA) model allows talented business people to raise capital and acquire firms that already have an established market positioning, offering a faster and less risky path to business ownership.

“Often there are people who have had an amazing idea or are good at doing something or have done something slightly differently, and their business has grown. But it doesn’t mean they're great at actually doing business,” explains Carl Lundberg, partner at Gerald Edelman, the London-based accountancy and advisory firm. “This is the other way around – the concept and marketplace are already proven, and you bring in the business acumen and entrepreneurial drive to take it to the next level.”

Already an established sub-sector of private equity in the US, ETA deals have gained more widespread momentum in the past decade as people not only recognise the potential of the model but have the necessary knowledge, support and crucially funding, to execute it. Lundberg’s 20-strong transaction services team at Gerald Edelman spend about 80% of their time on due diligence, of which about 70% is now ETA transaction related.

Why would entrepreneurs choose an ETA route over a start-up?

The main advantage is lower risk. Only 1 in 10 startups survive. The most common reasons for failure are an unviable business model and poor management. In the startup world, the need to disrupt often places the focus on innovation first and business model second. By contrast, ETAs take a working business model and infrastructure and then add the entrepreneur’s innovative thinking and drive to create more value.

How does it differ from traditional private equity investing?

The funding ecosystem that has evolved to support talented entrepreneurs in ETA ownership is one of the main differences. It is more personal and revolves around fewer investors backing the individual to elevate an existing - but still proven - business to new heights. The searcher is more accountable, remaining in the business after the acquisition and receiving support and mentorship from the investors.

“The stakes are high so you need that risk appetite,” says Lundberg. “But you also have much more flexibility - a PE fund will have specific metrics for a deal and if you fall outside that it’s difficult to move forward whereas with search funds you can go back to investors and discuss options more easily.”

The principles of acquiring an existing company are, however, very much the same. For investors, an attractive ‘searcher’ offers a relatively easy route into a private equity investment and, given the nature of the buyout opportunities - smaller, perhaps family-owned businesses, and baby boomers with succession challenges - deals typically have a smaller ticket size than those in traditional PE funds.

How are ETAs typically financed?

There are three main types of search fund through which ETAs are typically financed:

Traditional search funds: the acquisition entrepreneur finds and engages with a group of investors before searching for potential targets. Money is raised to fund both the search phase and to complete an acquisition.

Self-funded searchers: use their own time and resources to identify an acquisition target before approaching investors for funds to complete the deal.

Single sponsor search funds: raise funding from a single investor with the searcher often co-investing with that sponsor once a target has been identified.

Identifying the right business

A typical ETA search process looks at three high-level criteria: business characteristics, target industry and geography. Targets tend to be cash-generative businesses with recurring revenue that have been running for about ten years, often longer. They are stable businesses that, while profitable, are not reaching their full potential so searchers can bring fresh insights and modernisation.

“They tend to be ‘unsexy’ companies, the more mundane end of businesses – so not your tech where these characteristics would be hard to find,” says Lundberg. A lot of Gerald Edelman clients search in the light industrial and manufacturing industries, for example. Recent deals also included buyside support for the purchase of a chemicals company, pushchair supplier and training provider.

Developing an industry focus (and expertise) can help evaluate potential acquisition targets more quickly as well as differentiate your offer in a competitive acquisition process. Geographical focus can also help filter the candidates. But to narrow a search can be severely limiting.

“If you’re sector agnostic and looking for businesses with positive cash flow and low-hanging fruit in terms of growth then it’s much easier,” says Lundberg. “As soon as you eliminate other industries you are less likely to find the one that ticks all your boxes.”

Deal flow

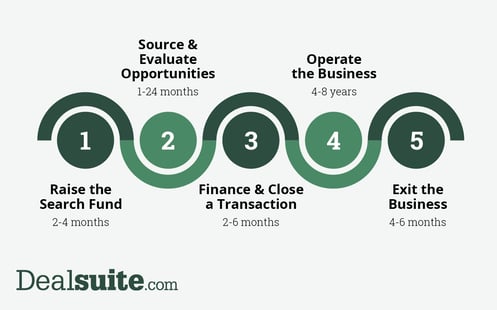

But where do you find these opportunities? Creating a robust deal flow pipeline is often among the most challenging aspects of ETAs but it is also vital to its success and has a significant impact on the time commitment required. Searchers typically reach out to thousands of business owners before finding the target they eventually acquire. As shown in the chart below, a typical search phase lasts for about two years.

Typical ETA process:

While proprietary deal flow is the ideal, it is exceptionally hard to come by and certainly in the quantity required. With self-funded searches on the rise, the reliance on inbound deal flow becomes even stronger. Gerald Edelman uses Dealsuite’s M&A platform with its clients to aid this process.

“It’s a numbers game and having a regular and sizeable list of deals to look at is super helpful,” explains Lundberg. “With Dealsuite you can set the parameters – geographical location, size, and so on – and then you get an email with a list of say 19 new projects that match your saved searches, which you can look at quite quickly.”

With the sell-side market more cautious, competition for deals is high and finding the right one is challenging so anything that enables this is invaluable.

Want to learn more about the possibilities of ETA? Get in touch with the Gerald Edelman team here.

Not a member yet? Book a Demo today to find out how you can benefit from Dealsuite.

.svg)

.svg)

.svg)

.svg)

.png?width=193&height=72&name=output-onlinepngtools%20(1).png)