CEE Dealmaker insights

Introduction

Thank you for taking the time to read the Dealmaker Insights for Central and Eastern Europe 2023-2024, by Dealsuite. This report consolidates research performed by Dealsuite, the leading tool for M&A transactions. It contains a summary of the (Western) European M&A Monitor by Dealsuite, CEE-mid- market-specific findings (companies with a revenue between €1 million and €50 million) and opinion- insights of selected CEE-dealmakers.

The assessment period is the second half of 2023 and an outlook towards 2024.

The aim of this study is to create periodic insights that improve the CEE market’s transparency and to serve as a benchmark for M&A professionals. We are convinced that sharing information within our network leads to an improved quality and volume of deals.

Floyd Plettenberg MSc. EMFC

CEO Dealsuite

I Findings transactions (Western) Europe

Most (Western) European transactions were closed in the Business Services sector.

Dealsuite compiles regional reports for DACH, UK & Ireland, France and the Netherlands. The aggregated results are displayed in the (Western) European M&A Monitor. The main findings of the European M&A Monitor for H2-2023 are summarised here. Read the full European M&A Monitor for H2-2023 here.

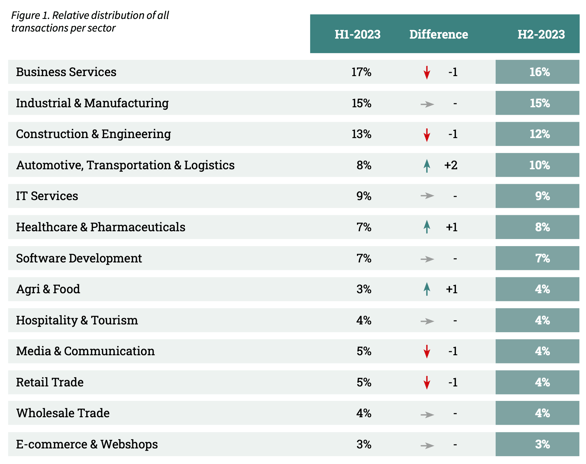

The distribution of transactions completed in H2-2023 across sectors is illustrated in Figure 1. There is a correlation to be expected between the relative size of a specific sector in the mid-market and the percentage of closed transactions. Despite a small drop of 1 percentage point, the most transactions were again closed in the Business Services sector (16%).

When examining the distribution of transactions across the four regions, the most significant discrepancy is observed in the Software Development sector. In the DACH region, 14% of the transactions occurred within this sector, whereas in the other three regions, the percentage was below 6%. In the Netherlands and the UK&I regions, the majority of transactions took place in the Business Services sector. Conversely, in France and the DACH region, the Industry & Production sector saw the highest number of transactions closed.

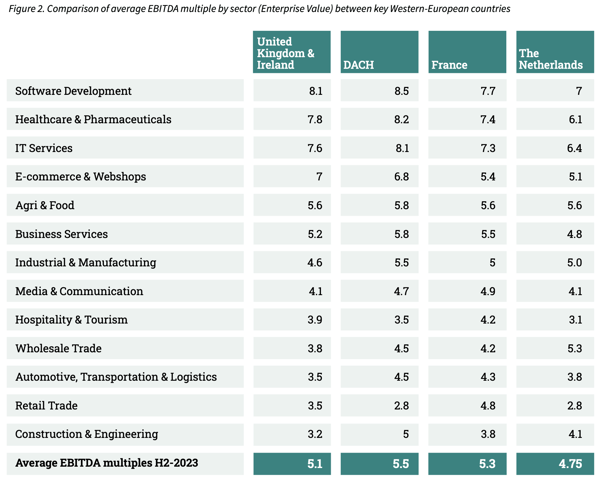

Software Development sector has highest EBITDA multiple across regions.

Across all four regions, the Software Development sector has the highest EBITDA multiple. In the DACH region, companies within this sector are valued at 8.5 times EBITDA, compared to 7 times EBITDA in the Netherlands. More significant differences in multiples are observed in the E-commerce & Webshops sector, with a 1.9 disparity between the UK&I (7 times EBITDA) and the Netherlands (5.1 times EBITDA).

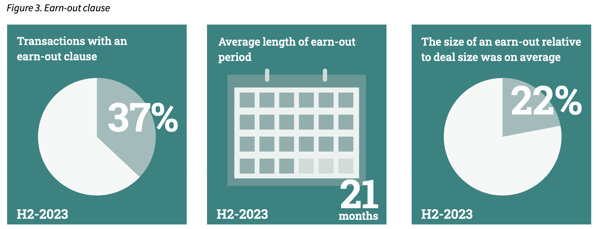

The size of an earn-out relative to deal size was on average 22%.

In transactions featuring earn-out arrangements, a portion of the sale proceeds is contingent on the company’s future performance. This arrangement means the seller doesn’t immediately receive the entire sale price and leave the company. Instead, they remain engaged with the company’s outcomes for a specified period, often including active participation on the board or as an external advisor. Earn-outs allow buyers to reduce the risk of overpaying, while sellers are motivated to ensure a smooth transition of the company.

In the second half of 2023, earn-out arrangements featured in on average 37% of transactions financed with debt. The average duration of earn-out arrangements was 21 months. On average, earn-outs constituted 22% of the deal value.

In the UK&I and France, earn-out arrangements featured in 42% of the debt-financed transactions. This was slightly less in the DACH region (36%) and the Netherlands (28%).

II Average transaction sizes in Central and Eastern Europe

In H2-2023 the majority of the deals took place in the segment € 2.5-10 million enterprise value.

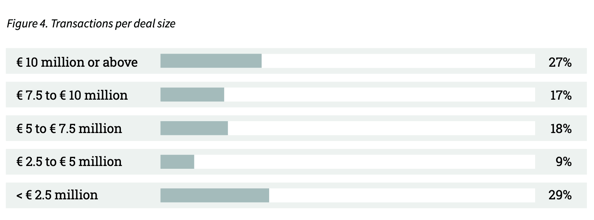

For the first time, we collected representative averages for transaction sizes in the CEE region. In H2-2023 the majority of the deals (44%) took place in the segment € 2.5-10 million enterprise value.

Nearly one third (29%) were smaller than € 2.5 million, and approximately the same number of transactions with an enterprise value above € 10 million (27%).

III Development assignments in Central and Eastern Europe

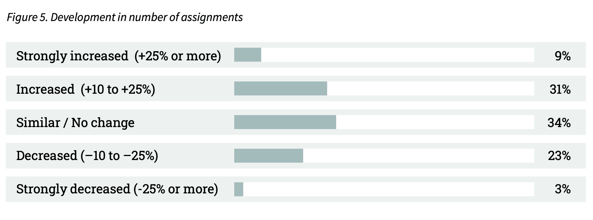

40% of CEE-advisors report an increase in the number of assignments in H2-2023.

The majority of advisors (40%) report an increased number of assignments compared to H1-2023.

One third (34%) perceives a similar situation compared to H1-2023 and 26% witnessed a decrease in assignments.

IV Outlook 2024 for Central and Eastern Europe

Majority of the advisors (70%) are optimistic about H1-2024.

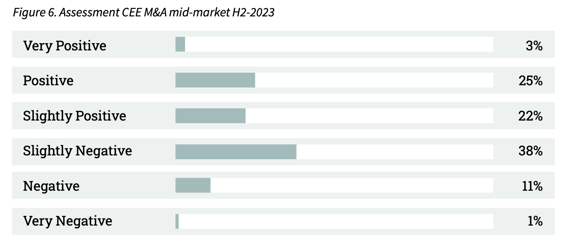

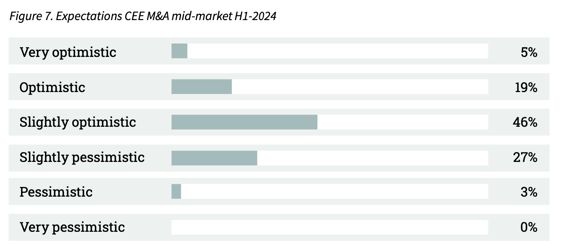

Assessing the performance of the CEE M&A mid-market is based on many factors, including the willing- ness of entrepreneurs to sell their businesses, funding availability, macroeconomic developments etc. An interpretation of these factors is needed to determine how the market will develop. The survey included both assessments of the M&A mid-market in H2-2023 (retrospective) and H1-2024 (projection).

The opinions about the past six months are mixed. Half of the advisors (50%) look back at H2-2023 with a mostly or very satisfied feeling, only 1% of the respondents perceive H2-2023 to be very negative. The expectations for the first half of 2024 are positive, 70% of the advisors are optimistic about H1-2024.

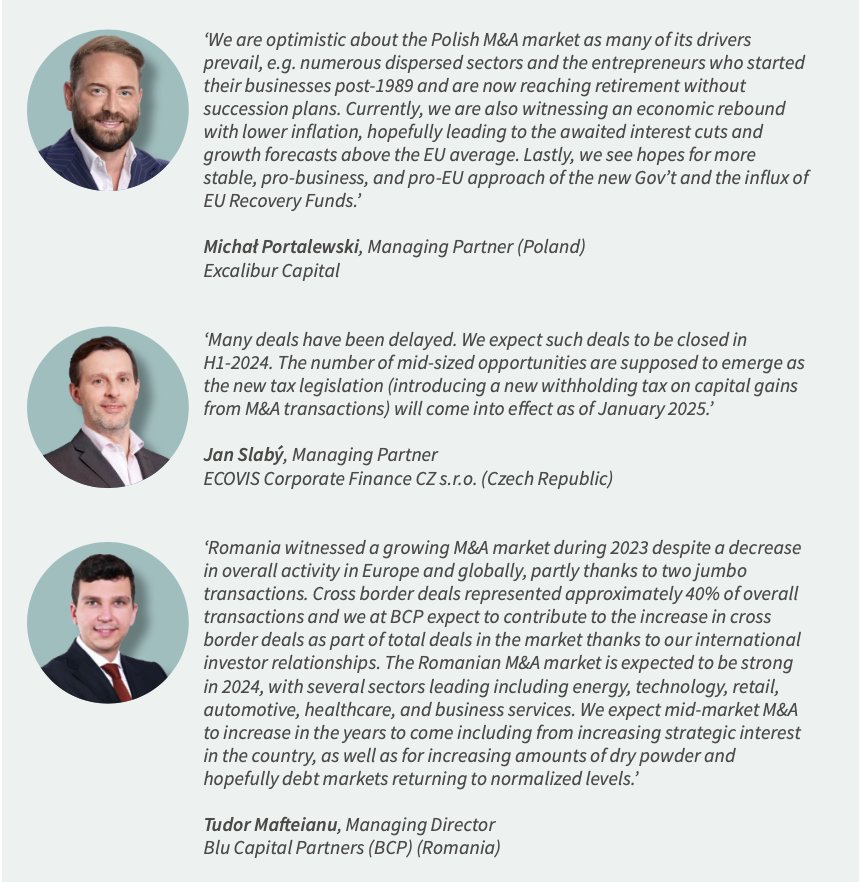

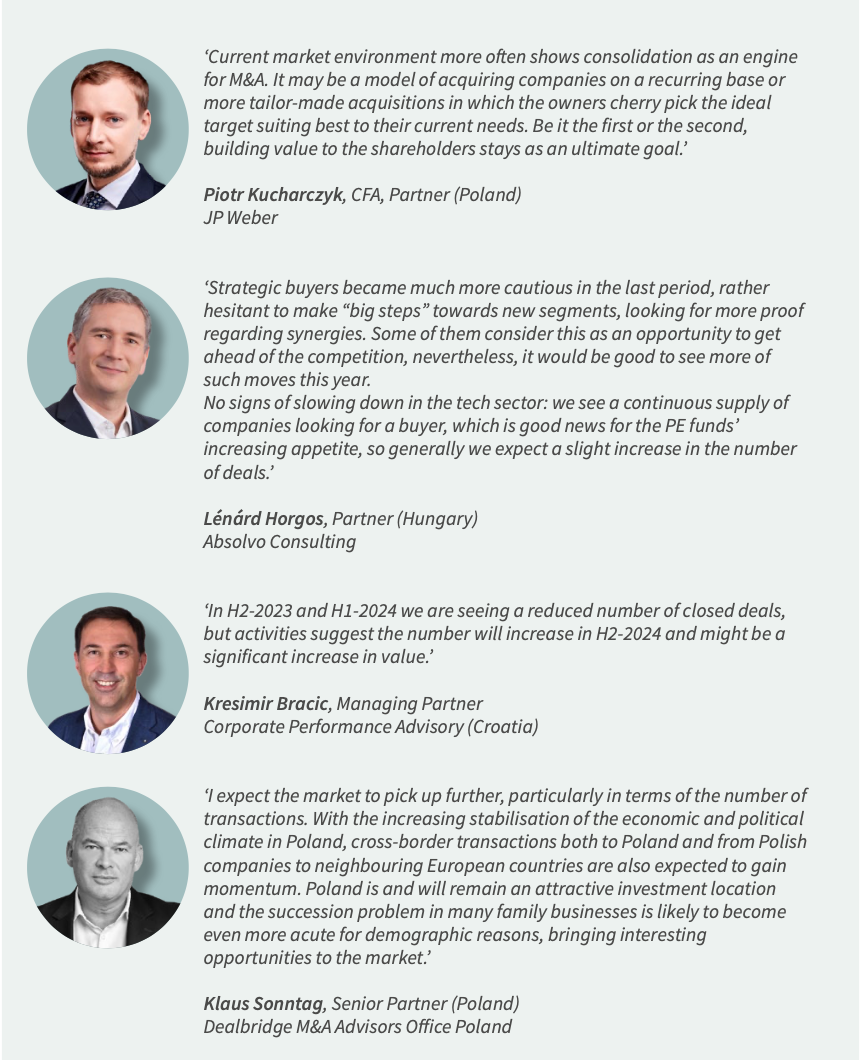

V Insights from CEE dealmakers

Dealsuite’s M&A mid-market trends report by Floyd Plettenberg covers topics such as market trends, strategy trends and execution trends. Read the M&A mid-market trends here.

We asked selected dealmakers from Central and Eastern Europe about their personal opinion on three key aspects of the M&A mid-market trend report.

The results below offer initial insights from M&A advisors in CEE and should not be considered represen- tative of all deals in the region.

M&A is transforming into Deals

We asked CEE dealmakers if they agreed to the following: Companies look to find partners in business, rather than targets (such a partnership may start without equity being transferred).

Of the respondents who expressed an opinion, the opinions were mostly agreeing. 59% agreed to the statement.

Though leader Floyd Plettenberg observes that new situations, new types of companies and new types of leadership are changing the M&A sector. Acquiring 100% of the shares is no longer the obvious choice.

“Companies should look to find partners in business, rather than targets. In that perspective the word ‘target’ will over time be replaced by the word ‘partner’.”

- Floyd Plettenberg 2023

‘Scale deal’ vs. ‘Scope deal’

In the M&A mid-market trends report we defined ‘scale deal’ and ‘scope deal’ as follows.

Scale acquisition: Company wants to realise a greater presence in a particular market or sector and aims to achieve a greater overall economy of scale.

Scope acquisition: Company seeks new capabilities and access to new markets or other complementary services.

We asked: Of the transactions your practice executed in 2023, what was the percentage of scope and scale deals?

Scale deals represented 48% of the respondents’ total deals 2023. Scope deals represented 34%. In the trend report (global trends) Dealsuite CEO Floyd Plettenberg observes a shift towards scope deals. An increasing number of buyers were looking to expand their capabilities through acquisitions. Our survey respondents on the M&A SME market in CEE exhibit a larger share of scale than scope deals in H2-2023.

Motives for acquisitions and investments

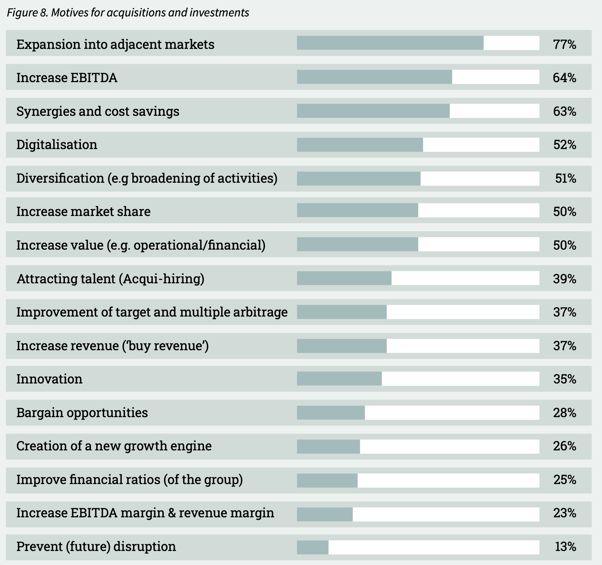

In the M&A mid-market trends report we defined 22 motives/objectives for acquisitions and investments.

We asked: Of the transactions your practice executed in 2023, what motives did you experience by the buyer/acquirer?

16 Of the motives were selected by the respondents, below is the distribution. 6 Of the motives were not selected at all.

Among our surveyed dealmakers, expansion into adjacent markets was identified as the primary motive (77%). Other frequently mentioned motives included increasing EBITDA (64%) and achieving synergies and cost savings (63%).

VI Method

The majority of M&A transactions take place in the mid-market. This report uses the definition of a mid- market company as having a revenue between €1 and €200 million. The survey that was the basis for the (Western) European M&A Monitor was sent to 1,330 M&A advisory firms. Considering their combined input, they represent an essential part of the M&A mid-market in Western-Europe. Out of the total of 1,330 advisory firms, we received 482 respondents (36.2% response rate).

We surveyed the M&A advisors in CEE for chapters II-V separately.

Sources used:

• Dealsuite M&A mid-market trends report 2023

• 482 survey responses from key Western-European M&A advisory firms

• Dealsuite M&A Monitors 2015 - 2023

• Dealsuite transaction data 2015-2023

• Field, A. (2011) Discovering Statistics SPSS. Third edition, SAGE publications, London. 1 -822

• Damodaran (2011). Equity Risk Premiums (ERP).

• Graham, J., Harvey, C., Puri, M., 2010. Managerial Attitudes and Corporate Actions. Working Paper, Duke.

This research was conducted by Alexandre Narayanin.

.svg)

.svg)

.svg)

.svg)