The ESG revolution in M&A

ESG grows more popular every day. From its coinage in 2005 as a set of aspects used by investors to screen investment opportunities, to more than 90 percent of S&P 500 companies now publishing ESG reports. This market trend can be observed across Europe, as more investors seek ways to align their portfolios with their values and mitigate long-term risks associated with unsustainable business practices. ESG is high on the agenda of consumers and institutional investors and because of that ESG and DEI criteria have become deciding factors in investments decisions of companies and Private Equity.

The European Commission has been implementing regulations and policies to encourage European companies to prioritise ESG practices within their businesses. Businesses that prioritise ESG are more likely to attract customers, talent, and partnerships, giving them a strategic advantage. Additionally, businesses with a strong ESG approach have been linked to having higher valuations, more profitability and a better shot at long term success.

We are convinced that a detailed ESG analysis and future planning for target companies will be main-stream within the next few years, and as a company we value contributing to this important topic. This E-Book explores the topic of ESG within the M&A market, the reason for its surge in M&A practices, added benefits and best practices for measuring ESG success. We trust you will use it to your advantage.

Yours faithfully,

Floyd Plettenberg MSc. EMFC

CEO Dealsuite

The surge of ESG within M&A practices

ESG activities have expanded considerably since the term was first coined in 2005. Still, it is only in the past few years that a noticeable shift has begun. What started as something to be managed alongside normal business operations is becoming intrinsically linked as non-financial or intangible assets – such as brand value and reputation - which are becoming a growing component of company value.

Policies and regulations

In an increasingly connected and transparent world, businesses of all sizes must pay attention to ESG, and stakeholders are quick to hold them accountable. In May 2021, Greenpeace and WWF commissioned a study in which they called out the UK finance sector for its carbon emissions level. The campaigners said British citizens would be shocked to learn that their money was being used in ways that ‘damage the environment.’ In the same month, a court ruled that Royal Dutch Shell should cut its greenhouse gas emissions faster than planned, a ruling that could have far-reaching implications for the rest of the global fossil fuel industry.

The EU’s Sustainable Finance Disclosure Regulation (SDFR), which came into force on the 10th of March 2021, requires all financial service providers to assess and disclose ESG considerations publicly. In the same month, the Securities and Exchange Commission (SEC) launched a task force dedicated to proactively addressing gaps or misstatements in ESG and climate change disclosures.

“Being able to produce means anticipating regulations and meeting the standards of tomorrow. It also means measuring the impact of climate change and a company’s activity. If water shortages mean that your company risks being subject to water restrictions for 3 or 6 months a year, there’s a good chance that you’ll be in danger if you don’t have preventative recycling or storage systems in place.” says Florence Farriaux, founding partner of Paris-based financial advisory and training firm FL Finance.

From 2024, companies with over 250 employees are required by regulation to address CSR concerns. However, these regulations indirectly affect smaller companies as well. Larger businesses must now examine the practices of their suppliers, including those of smaller companies.

Stakeholder pressure

ESG is high on the agenda of consumers and institutional investors (Limited partners) and because of that ESG and DEI criteria have become deciding factors in investments decisions of companies and Private Equity.

Investors, employees, consumers, and regulators alike demand that companies be more transparent about their social and environmental impacts and act within a sustainable investment framework. With less than a decade to deliver on the United Nations’ 17 Sustainable Development Goals (SDGs), investors are also looking to the private sector to show meaningful contribution to national efforts.

ESG metrics are becoming essential to all aspects of the M&A process, from initial selection to post-integration monitoring and reporting. Stakeholders will no longer accept a ‘greenwashing’ tickbox effort – managers will need to demonstrate that they have not only incorporated ESG into their investment methodologies but also that they are gaining financial value from it.

Sustainability principles

In the private equity space, the impact of ESG analysis is becoming more broad-based, with professionals increasingly recognising its importance at every stage of the investment life cycle.

ERM, a sustainability consultancy firm, conducted a study on ESG sentiments amongst 50 private equity firms. The study revealed that 93% of these firms believed investing in ESG opportunities would result in promising investment opportunities. Additionally, half of all respondents stated that having a strong ESG rating helped them win deals, while 70% expected ESG criteria to be a standard part of sell-side due diligence within the next 3-5 years. The study also found that having effective ESG frameworks increased the value of ownership, and disclosing robust ESG practices during selling led to positive exit multiples.

According to McKinsey’s research, a shift in mindset over the past decade has seen the perceived long-term value of environmental and social programs rival - or even exceed - the value attributed to governance programs. The most significant change is in the perceived value of social programs, with 93% saying they make a positive long-term contribution to financial performance versus 77% in 2009.

In 2021, Dealsuite conducted a study to examine the relevance of ESG to investment decisions and the effect on valuation in the SME M&A market. The results showed that 90% of advisors in Western Europe say they expect ESG performance to have an effect on the valuations of SMEs. Such high levels of confidence reflect a strong shift in attitudes to ESG issues among both investors and consumers.

The added benefit of having strong ESG fundamentals

A strong ESG framework suggests robust risk management, strong employee and customer retention, and – ultimately - a more resilient, sustainable business. And with the global pandemic as a backdrop, business resilience, and future-proofing have become more highly valued than ever before.

Moreover, these benefits compound over time – ‘quality’ companies have higher multiples, attracting more investor attention and leading to sustainably higher multiples.

Better valuations

M&A professionals increasingly recognize the importance of environmental, social, and corporate governance (ESG) criteria in value creation. A targeted ESG approach can result in higher valuations throughout the M&A lifecycle. From uncovering the best investment opportunities to securing the optimum exit multiple, strong ESG credentials typically equate to a premium.

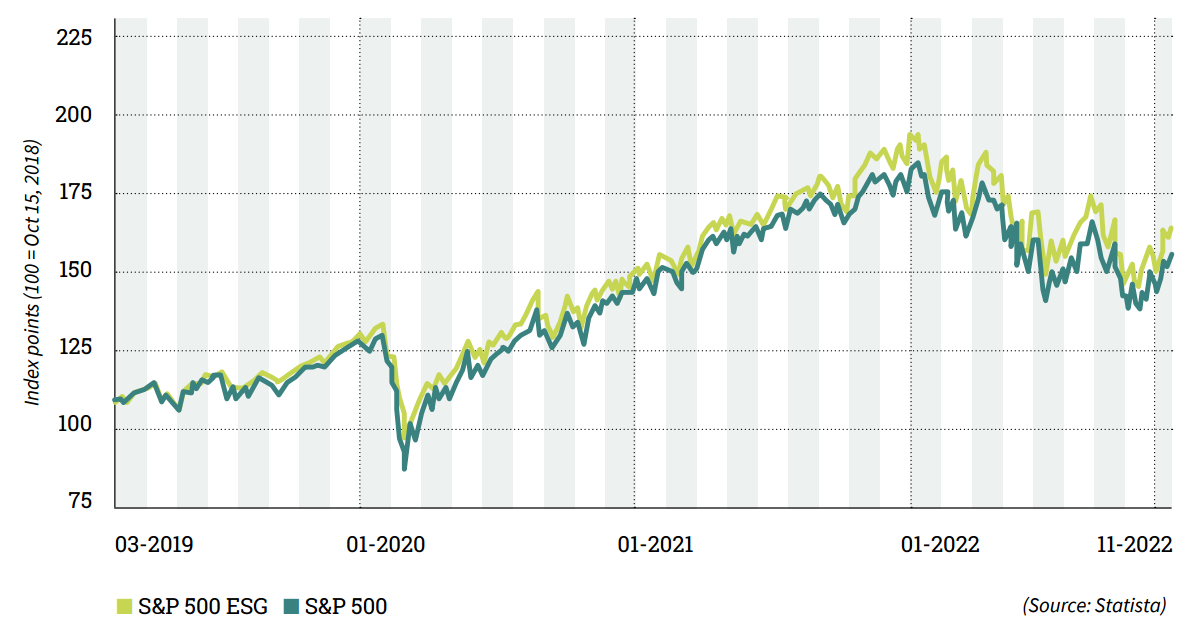

Finally, when looking at more recent data, such as the index points of the S&P 500 and S&P 500 ESG, we can see that after 2020, the S&P 500 ESG outperforms the S&P 500. Recent economic and social trends have led to higher levels of ESG integration among firms worldwide and higher prioritisation from investors to include ESG-focused firms in their investment choices.

Companies with strong ESG are more profitable

PwC estimates that ESG-related funds will be worth US$33.9tn by 2026, with ESG assets on track to make up more than a fifth of total global assets under management within five years.

Growing acknowledgment that ESG is a driver of value creation is pushing adoption into the next phase, according to a report by PwC. Its 2021 Global Private Equity Responsible Investing Survey found that 66% of respondents ranked value creation among their top three motivations for ESG activity. Large asset managers, including BlackRock, have openly stressed the importance of comparable ESG data and made it essential to all their investment processes.

While businesses can directly enhance their bottom line by focusing their brand awareness on their ESG credentials or reducing their electricity consumption, they can also take advantage of the sustainability premium investors offer for a clear, concise, and robust ESG strategy. Fundamentally, investors are prepared to accept lower returns if the companies they invest in are environmentally savvy and contribute to society.

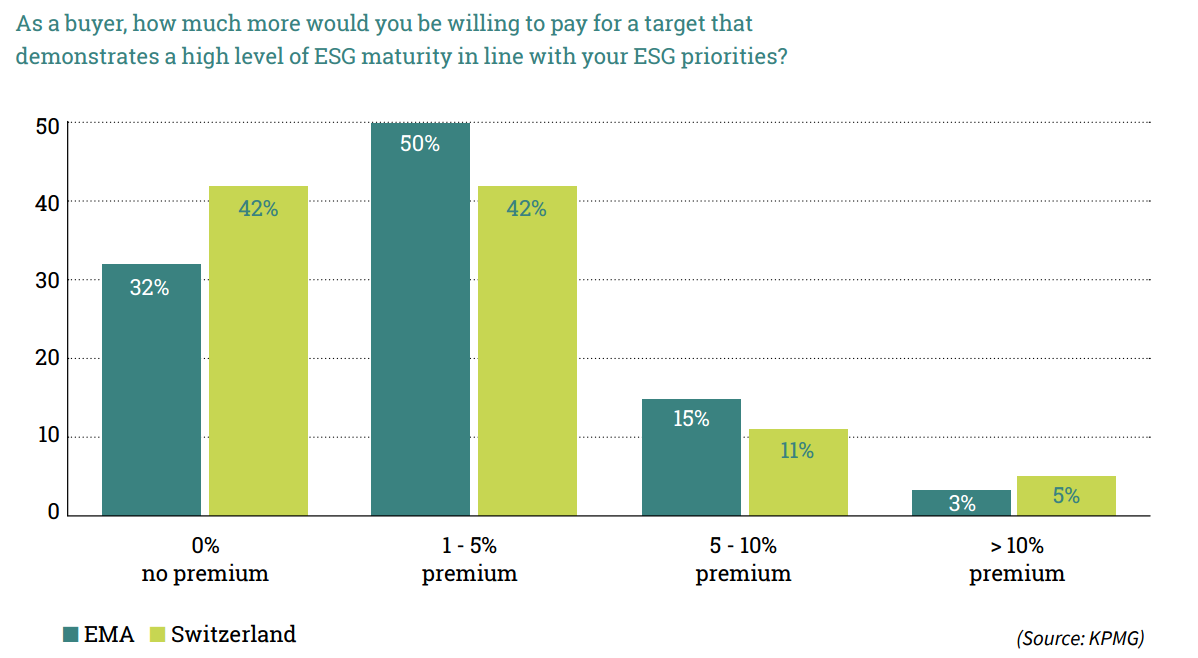

In a 2023 study by KPMG, dealmakers from EMA and Switzerland were asked how much more they would pay for a company in line with their ESG priorities. The results showed that more than two-thirds of dealmakers in EMA and Switzerland are willing to pay a premium.

Better shot at long-term success

At the mid-market level, ESG is often about more than formal policies and practices. How a company presents itself to investors can be just as important.

Investors want to invest their money in businesses that will bring long-term returns. As mentioned in the previous chapter, policies and regulations, stakeholder pressure, and sustainability principles, are causing a surge in the importance of ESG fundamentals within M&A. Investors prioritize deals that they believe will have a positive impact on the future and will not cause them to be penalised for not complying with ESG policies and regulations.

Findings point to a correlation between strong ESG principles and long-term success. EY’s research shows that sustainable companies outperform their industry peers on gross profit, EBITDA, EBIT, and net profit metrics. For long-term value, companies need strategic lenses for defining how a business creates, delivers, and measures value across the planet, people, governance, and prosperity. A solid understanding of what drives future long-term value is crucial in a corporate ESG journey.

Measuring ESG success

One of the main obstacles to widespread adoption has been measurement. ESG is notoriously hard to define and broad in scope, from diversity and employment practices to privacy and data security policies.

To date, there has been no accepted benchmark for investors to compare the ESG credentials of various companies, and - with a reliance on self-reported information within annual reports or on company websites – a massive variation in inputs.

Some headway has been made with various organisations and initiatives helping businesses understand and disclose their impacts on issues such as climate change and gender diversity, including the UN Principles for Responsible Investment (UNPRI), the Global Reporting Initiative (GRI), and the Sustainability Accounting Standards Board (SASB).

Despite not having a set agreement on how to measure ESG, the simple fact that more companies are reporting their ESG practices means that we are getting closer to a standardisation of an ESG reporting framework.

In May of 2022, PwC published a report about their ESG measurement framework meant to drive standardisation and improvement in ESG measurement to encourage the private and public sectors to deliver strong ESG outcomes that will help meet UN Sustainable Development Goals.

In KPMG’s recent study, the approach of experienced international financial investors on ESG due diligence has been investigated in order to define 7 best practices.

Meanwhile, global data providers such as Refinitiv and Morningstar provide insights by measuring decisions taken by company management and assessing their potential impact on future strategic direction and operational efficiency. Based on publicly reported data, these ESG metrics validate and analyse hundreds of data points for global businesses.

The industry difference for ESG

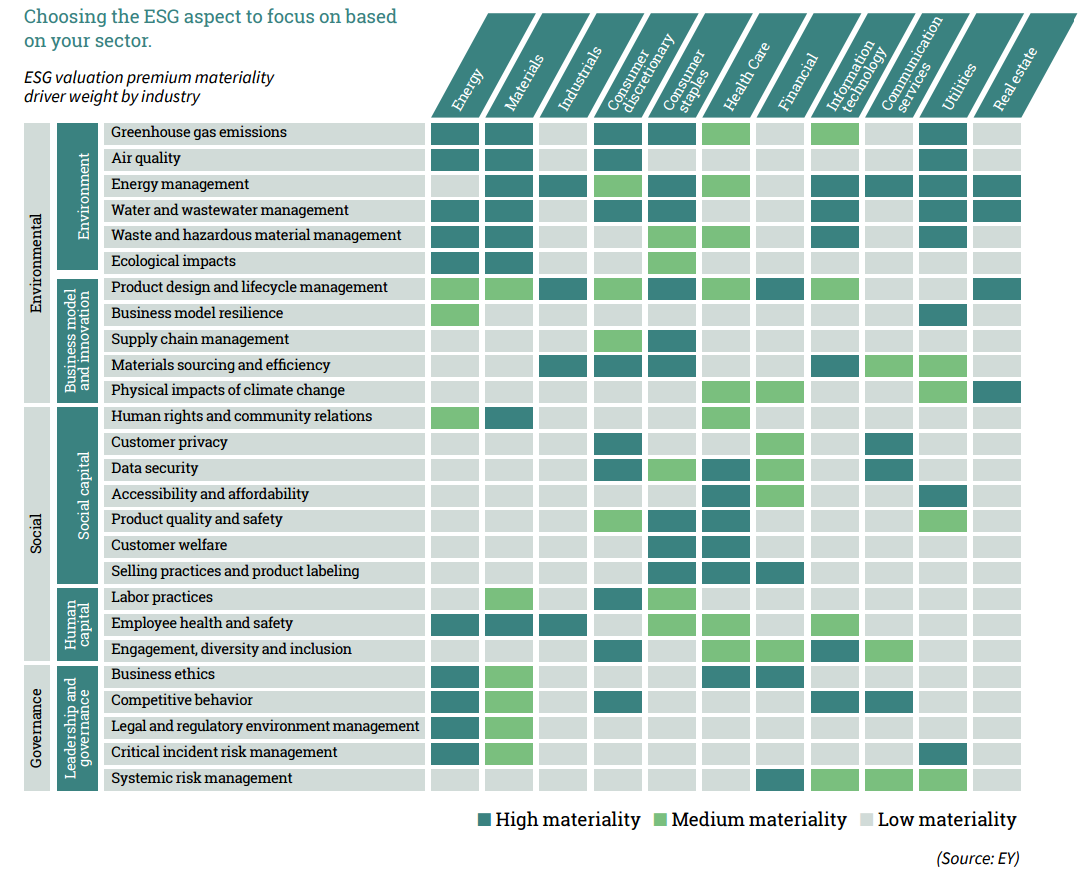

Depending on the industry, some elements are more relevant than others. McKinsey states that for companies in the industrial and energy sectors, for example, surveyed investors seek out ESG initiatives in the environmental dimension, while investors prioritize social initiatives for pharmaceutical companies.

When comparing similar companies based on ESG efforts, a difference can be spotted between industry peers. Companies that direct their efforts on the most material ESG aspects for their sector, have demonstrated a higher alpha than peers that do not. The following illustration from EY shows a helpful guide on which ESG aspect to focus on based on your sector.

.svg)

.svg)

.svg)

.svg)