European Private Equity Monitor 2024

This report by Dealsuite offers insights into statistics and trends within the European Private Equity market. 512 European PE professionals took part in the survey for this research. The study aims to provide valuable insights about Private Equity to board members, entrepreneurs and other professionals in the sector, contributing to a positive reflection of the Private Equity domain. While we have been publishing local and regional M&A reports for many years, this is the first publication of our annual Private Equity report. We are convinced that sharing information within our network leads to an improved quality and volume of deals.

Floyd Plettenberg MSc. EMFC

CEO Dealsuite

I Investment horizons

Significant increase in the average investment horizon reported.

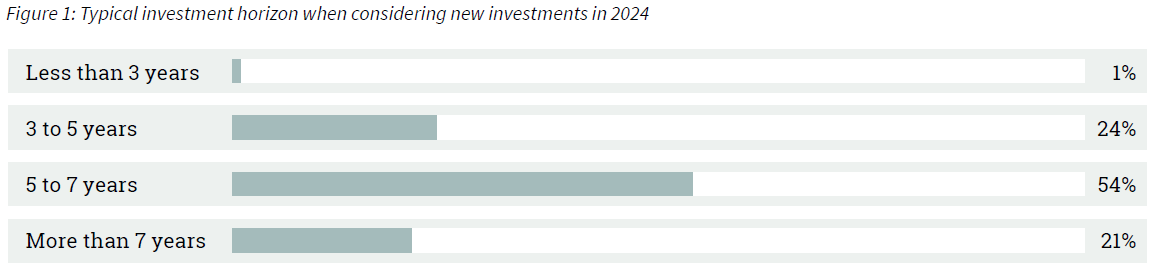

The typical investment horizon varies from firm to firm. Furthermore, the exact timing of an exit depends on a variety of factors, some company-specific and some dependent on the broader economic landscape. Such factors include, but are not limited to, the achievement of growth plans, market conditions, buyer interest, and value creation opportunity. (Warren, Geoffrey J, 2014) In this edition of the Private Equity monitor Dealsuite asked PE professionals about their typical investment horizon for new investments in 2024. The results are shown in Figure 1.

Only 1% of PE professionals considers an investment horizon of less than 3 years. The majority of PE professionals considers a holding period of more than 5 years (75%).

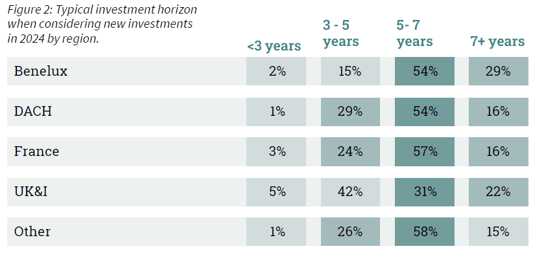

Investment horizons vary per geography, where some regions clearly have a longer investment horizon than others. Figure 2 shows the typical investment horizon per region. Looking at the average responses per region, PE professionals from the Benelux seem to apply the longest investment horizon. 29% of Benelux respondents apply an investment horizon of more than 7 years. Over half of the Benelux respondents apply an investment horizon of 5 to 7 years. 47% of respondents from the UK&I apply an investment horizon of less than 5 years. In all regions, the majority of PE professionals have an investment horizon of more than 5 years.

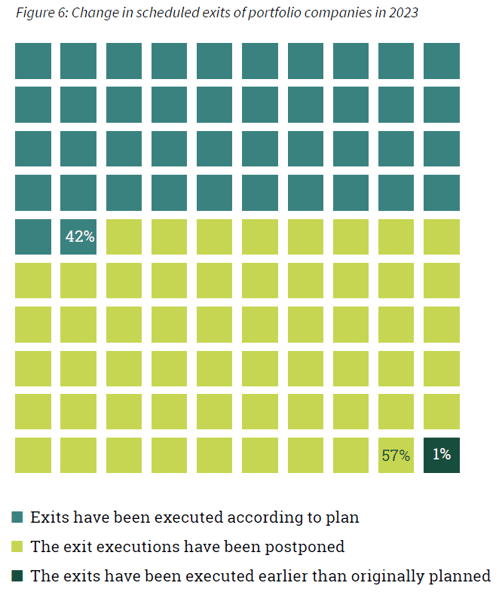

(57%) of PE professionals have postponed their planned exits for 2023.

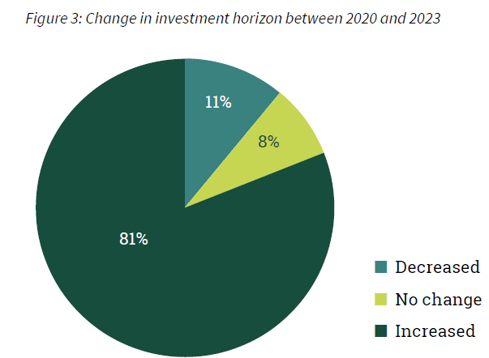

The scheduled exit of a portfolio company is subject to various factors and circumstances that may lead to changes or delays. The pandemic, inflation, increasing interest rates and the Ukraine war all had a significant impact on market conditions in the previous years, influencing exit potential. Figure 3 shows the change in investment horizon between 2020 and 2023.

81% of PE professionals report an increase in the investment horizon in the previous 3 years. 11% of respondents noted a shorter investment horizon between 2020 and 2023, and 8% of respondents did not notice any change in investment horizon. On average, the investment horizon increased by 13 months.

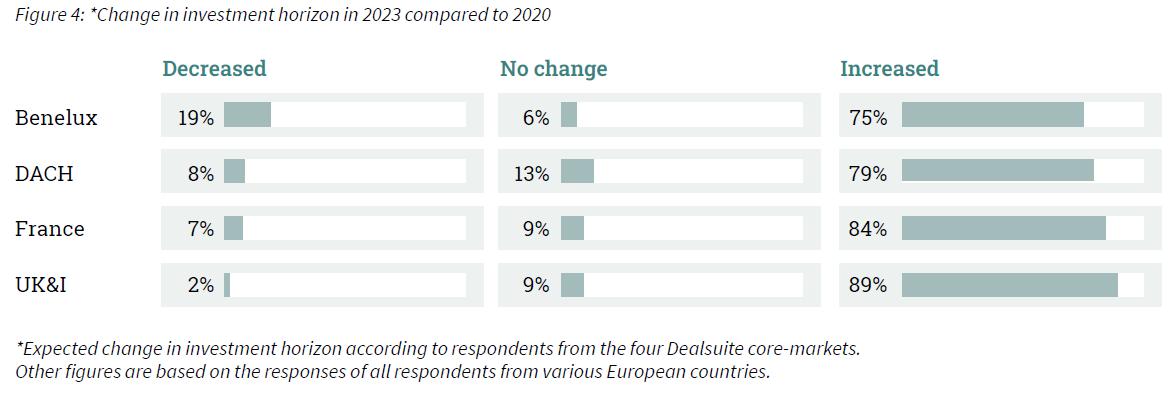

According to Figure 2, 47% of UK&I professionals apply an investment horizon of less than 5 years. This is the largest percentage compared to the other markets. However, 89% of UK&I respondents also saw their investment horizon increase between 2020 and 2023. The results are shown in Figure 4.

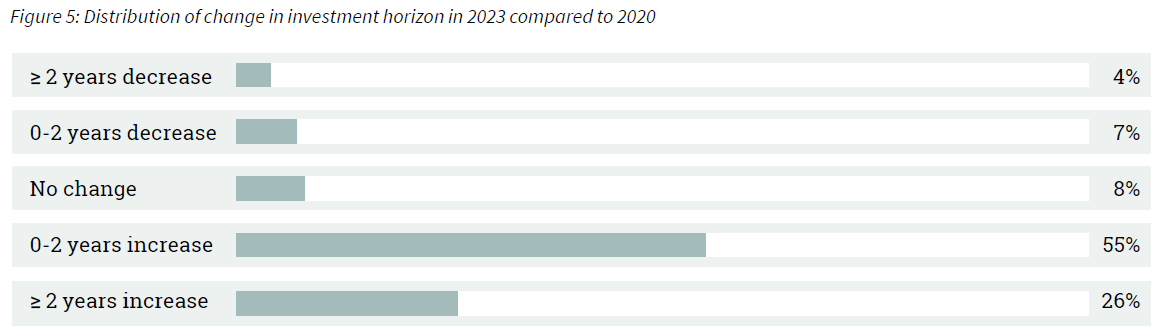

Figure 5 shows the distribution of responses on change in investment horizon. 55% of respondents report an increase in investment horizon between 0 and 2 years. 26% of respondents report an increase in investment horizon of 2 or more years. 4% of respondents notice a decrease in investment horizon of 2 or more years.

Figure 6 shows the change in scheduled exits of portfolio companies in 2023. From the respondents that planned an exit for 2023, 42% of the PE professionals have executed the exits according to plan. 57% of respondents report to have postponed the planned exits, and 1% executed the exit earlier than originally planned.

II Raising Capital

Raising capital has become more difficult in 2023 according to 71% of the PE professionals.

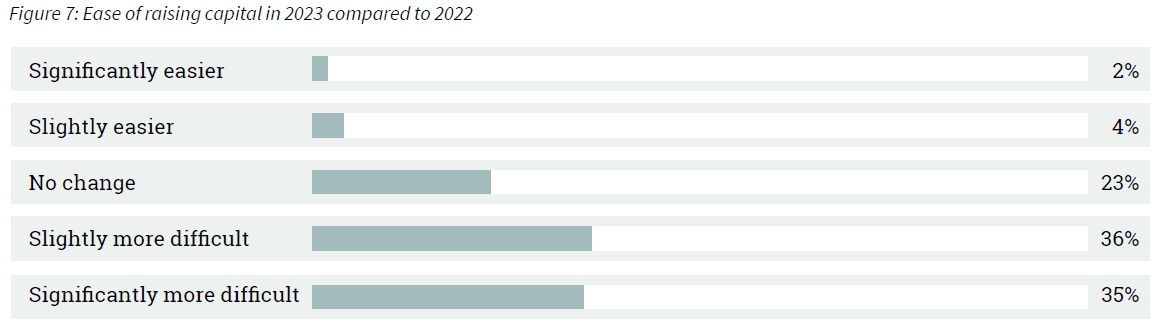

The ease of raising capital is influenced by several factors such as inflation or high interest rates. Fundraising has proven to be difficult in the previous years. Data from Pitchbook’s 2022 Annual European PE Breakdown showed that fundraising in Europe was at its lowest since 2014 in terms of capital raised. PE professionals were asked to report on the ease of raising capital in 2023 compared to 2022. The results are shown in Figure 7.

From the PE professionals that have raised capital in 2023, the majority reports that fundraising has become more difficult in 2023 (71%). 6% of PE professionals experienced more ease in raising capital and 23% did not note a difference.

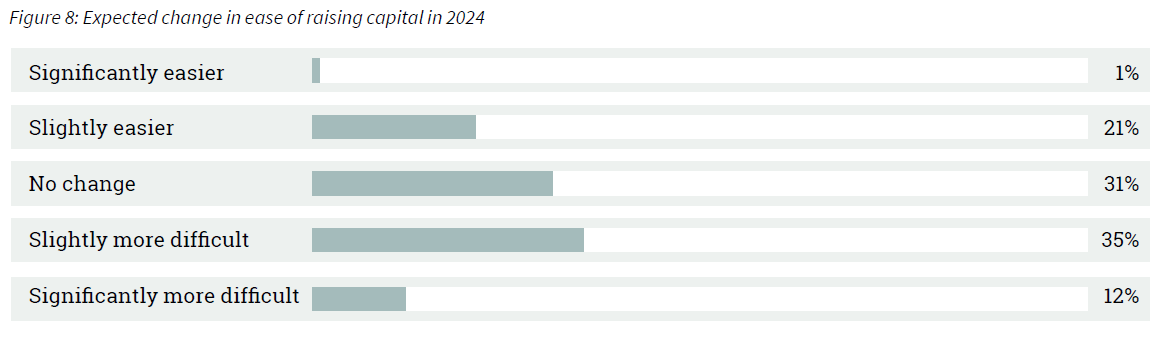

Figure 8 shows the expected change in ease of raising capital in 2024. 47% of respondents expect it to become more difficult to raise capital in 2024. 22% of respondents expect it to become easier.

III AI in Private Equity

Over half of the Private Equity professionals have never used AI to support their PE activities (53%).

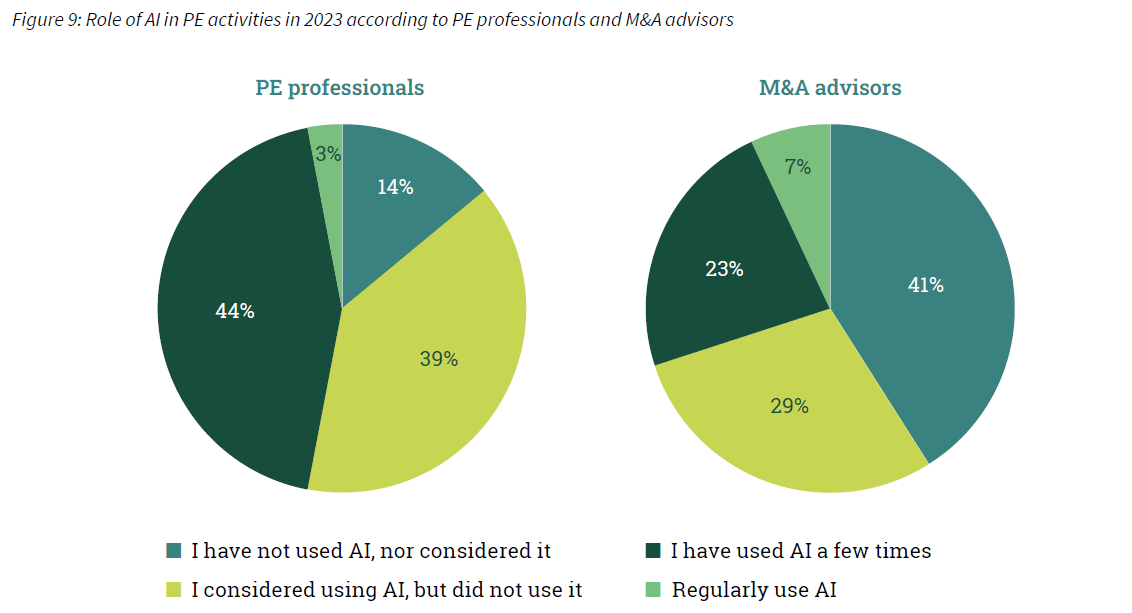

The introduction of AI solutions such as Chat GPT allows for quick access to data and streamlining of tasks. New ways of working deepen the understanding of potential deal partners in the broader ecosystem and decrease geographical barriers. Sourcing, screening and scoring deal targets has become more accessible. Figure 9 shows the role of AI in PE activities in 2023.

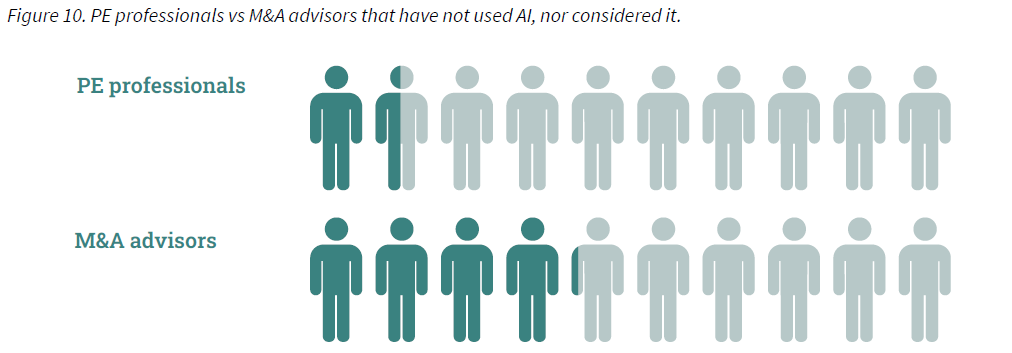

In September 2023, research was conducted by Dealsuite on the use of AI by M&A advisors active on the buy or sell-side in mid-market transactions. According to the European M&A Monitor, 41% of M&A advisors have not used AI and are also not considering it. 30% of European M&A advisors make use of AI to support in M&A processes. Private Equity professionals seem to make more use of AI with almost half of the respondents having used or regularly using AI (47%).

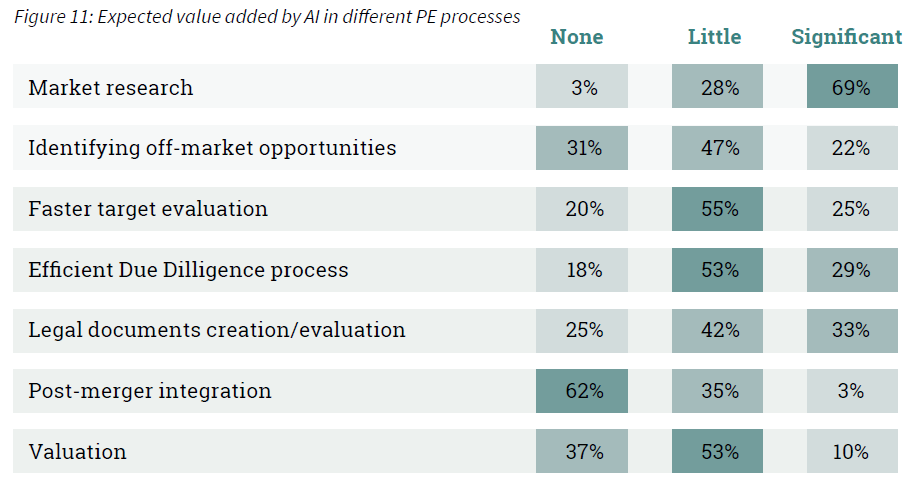

AI can support in various PE processes from market research to post-merger integration. On average, 69% of respondents agree that AI will add significant value to the market research process, where only 3% of respondents do not think it will add any value in this process. The opinions on the added value of AI in the legal documents creation/evaluation process are diverse. 25% of PE professionals think AI will not add any value in this process, while 33% of professionals believe it will add significant value.

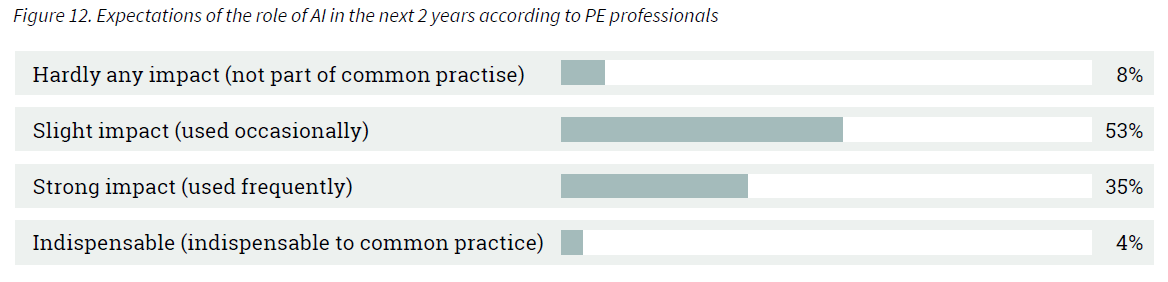

More people become familiar with AI and its benefits. PE professionals were asked about how they see the role of AI develop in the upcoming 2 years. The opinions are mixed, on average, 61% of the advisors expect AI to have a slight impact or no impact at all, while 39% of the advisors expect AI to have a strong impact or even be indispensable.

IV Opportunities in the lower mid-market

According to 73% of respondents, there is an increased interest in the lower mid-market.

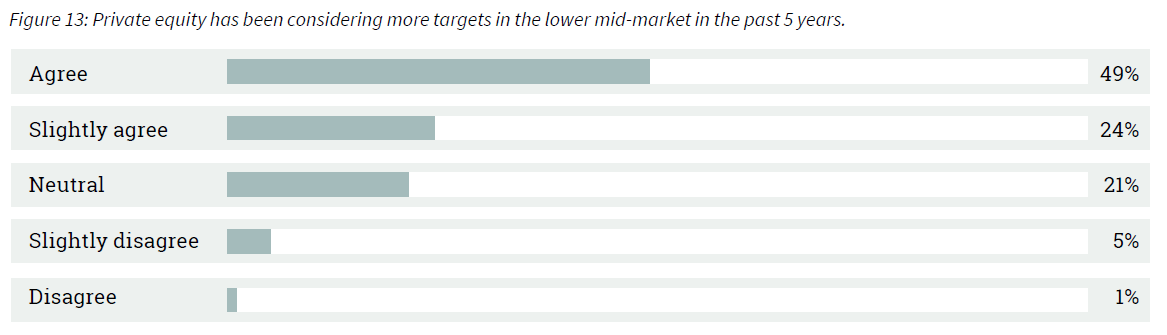

Traditionally, PE firms were known for favouring the bigger deals. Now there is an increasing interest to also consider companies active in the lower mid-market. The interest is driven by various opportunities from value creation and growth to an enhanced portfolio diversification. 73% of respondents agree that PE firms are considering more targets in the lower mid-market. The results are shown in Figure 13.

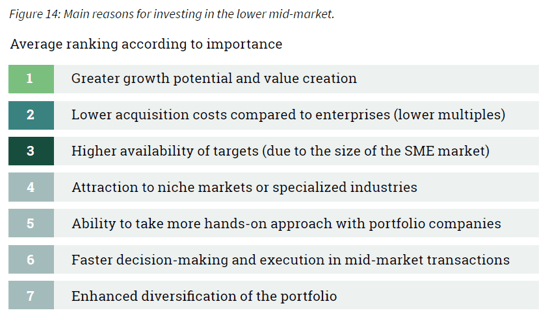

PE professionals expressed the reasoning for their interest in the lower mid-market by ranking 7 reasons from most important to least important. The results are given in Figure 14. On average, the greater growth potential and value creation is the main reason for acquiring in the lower mid-market. Despite this being the main reason, 43% of respondents argue that the lower acquisition costs is the most important reason for acquiring in the lower mid-market.

V Value growth

31% of value growth of portfolio companies can be attributed to operational improvements.

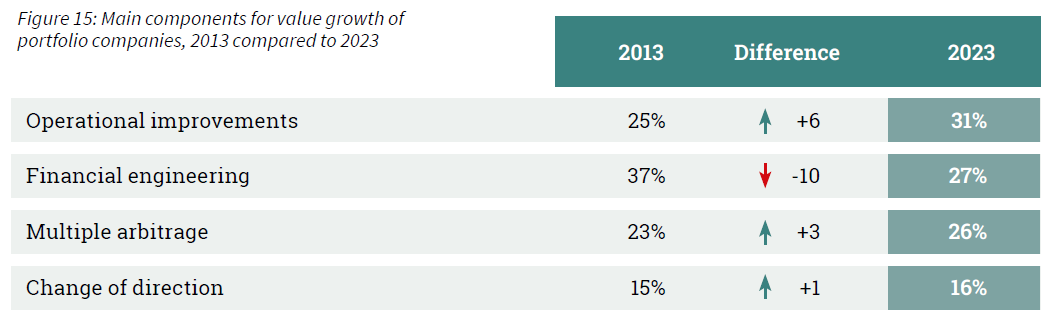

Private Equity firms leverage their expertise and resources to direct portfolio companies toward increased profitability and long-term success. There are various components that drive the value growth of a portfolio firm. Respondents expressed which components are the main drivers for value growth by distributing 100% over the four components in Figure 15. They also expressed which components were the main drivers in 2013.

On average, 16% of value growth of portfolio companies can be attributed to a change of direction. Operational improvements increased from 25% to 31% of attributed value and seems to attribute most to the value growth. Where in 2013 the largest value driver used to be Financial engineering with 37%, this decreased to 27% in 2023.

VI Retrospect and outlook

47% of respondents expect more acquisitions in 2024.

Assessing the performance of the Private Equity market is based on many factors, including : the ease of raising capital, the number of companies open to sell their business, the exit potential of portfolio companies, macroeconomic development, the performance of portfolio companies etc. An interpretation of these factors is needed to determine how the market will develop. The survey included both the assessments of the PE market in 2023 (retrospective) and the expectations for 2024 (projection).

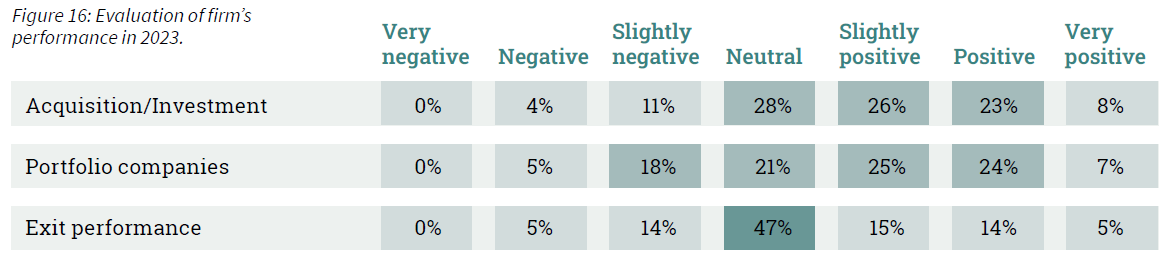

Figure 16 shows the evaluation of PE activities in 2023. 23% of the respondents report a negative performance of their own portfolio companies in 2023. Almost half of the respondents (47%) have a neutral opinion about the performance of their exits in 2023, while 34% of PE professionals look back at their exits with a positive feeling. Over half of respondents are positive about the evaluation of their acquisitions/investments (57%). This evaluation is based on the overall performance of their acquisitions/investments, including the transaction prices and number of transactions. This evaluation is based on the overall performance of their acquisitions/investments, including the transaction prices and number of transactions.

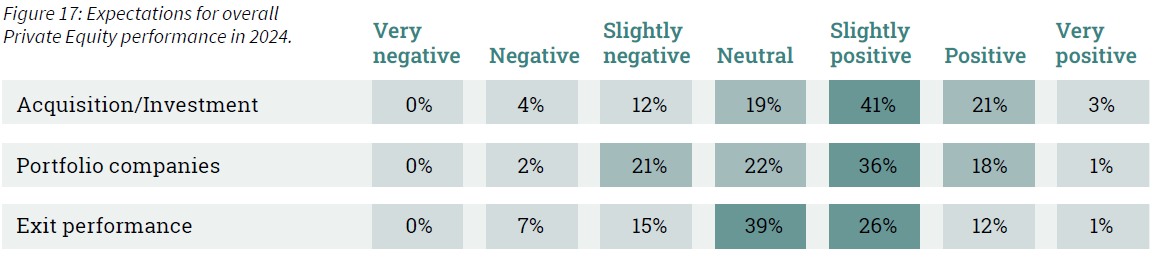

The expectations for the overall performance of Private Equity in 2024 are shown in Figure 17. The majority of respondents have optimistic expectations for the performance of acquisitions and investments in 2024 (65%). The expectations for the performance of exits in 2024 are more varied. 22% of respondents have pessimistic expectations, 39% have neutral expectations and 39% of the respondents have positive expectations for the scheduled exits.

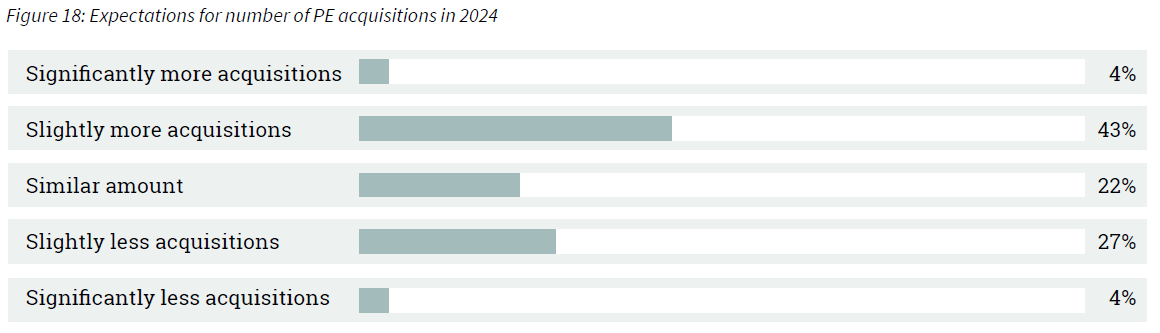

As discussed in chapter 1, 57% of exits that were originally scheduled for 2023 have been postponed. The performance and number of exits of PE firms can significantly impact the number of acquisitions. A positive exit performance can for example lead to increased capital availability, investor confidence, and improved deal flow. 47% of respondents expect an increase in the number of acquisitions in 2024.

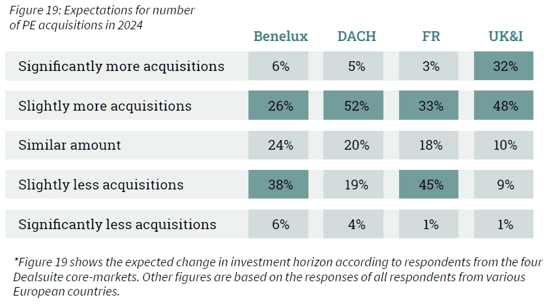

Figure 19 shows the expectations for the number of acquisitions divided by respondents from the different Dealsuite core-markets. 80% of respondents from the UK&I expect more acquisitions in 2024, while 36% of French respondents expect an increase. 44% of respondents from the Benelux expect an decrease in the number of acquisitions.

VII Method

The aim of this study is to provide valuable insights about Private Equity to entrepreneurs and other professionals in the sector, contributing to a positive reflection of the Private Equity domain. 512 Private Equity firms spread around Europe have participated in the research for this Private Equity monitor. Considering their combined input, they represent an essential part of the Private Equity market in Europe.

Sources used:

• 512 survey responses from European Private Equity professionals

• Gabbert, J., Tarhuni, N., & Cox, D. (2023). European PE Breakdown

• Dealsuite European M&A Monitor, September 2023

• Warren, Geoffrey J., Long-Term Investing: What Determines Investment Horizon? (October 21, 2014). CIFR Paper No. 39

This research was conducted by Jelle Stuij and Roos Bijvoet. For further questions, please contact Maarten Reinders, CCO Dealsuite.

.svg)

.svg)

.svg)

.svg)