A look into the UK healthcare & life science market

The UK healthcare and life science markets have evolved to become one of the largest in the world. Between them, they span a range of subsectors including life sciences, biotechnology, pharmaceutical, and medical care.

Over the past 10 years, the healthcare and life science sectors have become a safe haven for investors. Pressures created by an ageing population, rise in obesity and the pandemic have driven an increasing need for research and development facilities, all while speeding up the growth of medical organisations.

Market

Subsectors of the UK health and life sciences industries are heavily interlinked, with each division often competing for Government funding, as well as external factors (such as the Covid pandemic) influencing the prioritisation of developments. The UK healthcare sector remains strong, receiving perpetual and growing funding from the Government as a result of societal pressures, as well as significant economic growth opportunities through research and development.

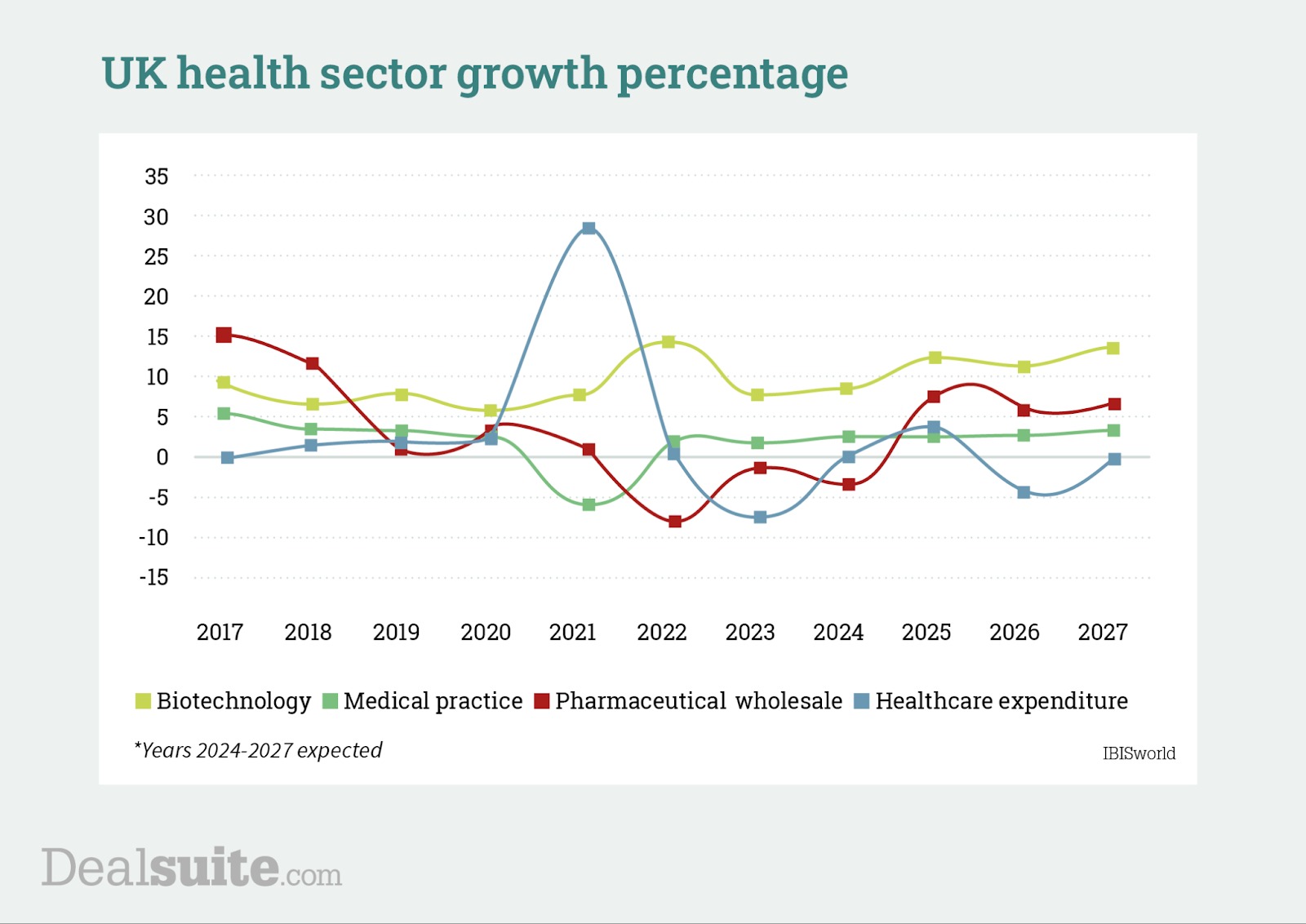

The UK Government healthcare expenditure is roughly 185 billion pounds in 2023. Because of a steady growth in population as well as an increase in societal demand, the budget for healthcare in the UK is expected to increase at a 4.3% Compound Annual Growth Rate (CAGR) from 2018 to 2025.

Market valuations and revenues of businesses across all subsectors of healthcare are seeing positive growth. This growth is aided by an increase of Government spending and demographic changes.

The UK biotechnology sector, which creates products and applications using biological systems, is valued at around 19.8 billion pounds in 2023. This sector is also expected to grow with a forecast CAGR of 12.2% from 2023 to 2028. Biotechnology companies that are researching diagnostic techniques and human health products have benefitted from a rise in private and Government funding post-Covid, raising a record 4.5 billion pounds of investment in 2021 and increasing industry revenues by about 15% during 2021 to 2022.

The UK pharmaceutical wholesaling sector is valued at circa 51.8 billion pounds in 2023, exhibiting a Compound Annual Growth Rate of circa 6.3% from 2023 to 2028. However, during 2018 to 2023, strict regulation slowed market growth to -0.7% CAGR. This set back Government legislation and caused the loss of patent protection for several high-profile drugs. In turn this caused a boost in generic pharmaceutical products which created downward pricing pressures within the industry.

The UK medical practices sector, including general practitioners, is currently valued at 15 billion pounds in 2023, with a CAGR of 3.5% anticipated from 2023 to 2028. Currently, there are Government plans in place to boost NHS funding and increase available GP appointments by 50 million a year in 2024. For comparison, there were about 242 million appointments in 2019. These Government plans are expected to positively affect the growth of UK medical practices.

Growth Factors

In 2021, the UK Government exceeded budgeted healthcare expenditure by 29%. The pandemic directly contributed to this, as the government used emergency funds to combat the spread of the virus and assist those with immediate health risks.

In 2022, funding for health services in England reduced by 1.2% as Covid-related pressures began to subside. However, the expenditure is expected to rise by 2.4% from 2023 to 2025, according to the King’s Fund.

Changing demographics are also contributing to growth across the sector. These include:

- An increase in people over the age of 65: In 2021 the Government census reported that about 18.6% of the population (over 11 million people) were over the age of 65. This is a big increase compared to the 16.4% recorded in 2011. This rise in elderly encouraged sector growth by placing greater pressure on the UK healthcare system and increasing demand for treatments.

- Rise in obesity: The office for health improvements and disparities reports that in 2021 to 2022, 22.3% of the population was overweight or obese. Increasing levels of obesity in the adult population in the UK is placing pressure on medical services, leading to an anticipated increase in healthcare spending in the short and medium term.

M&A Activity

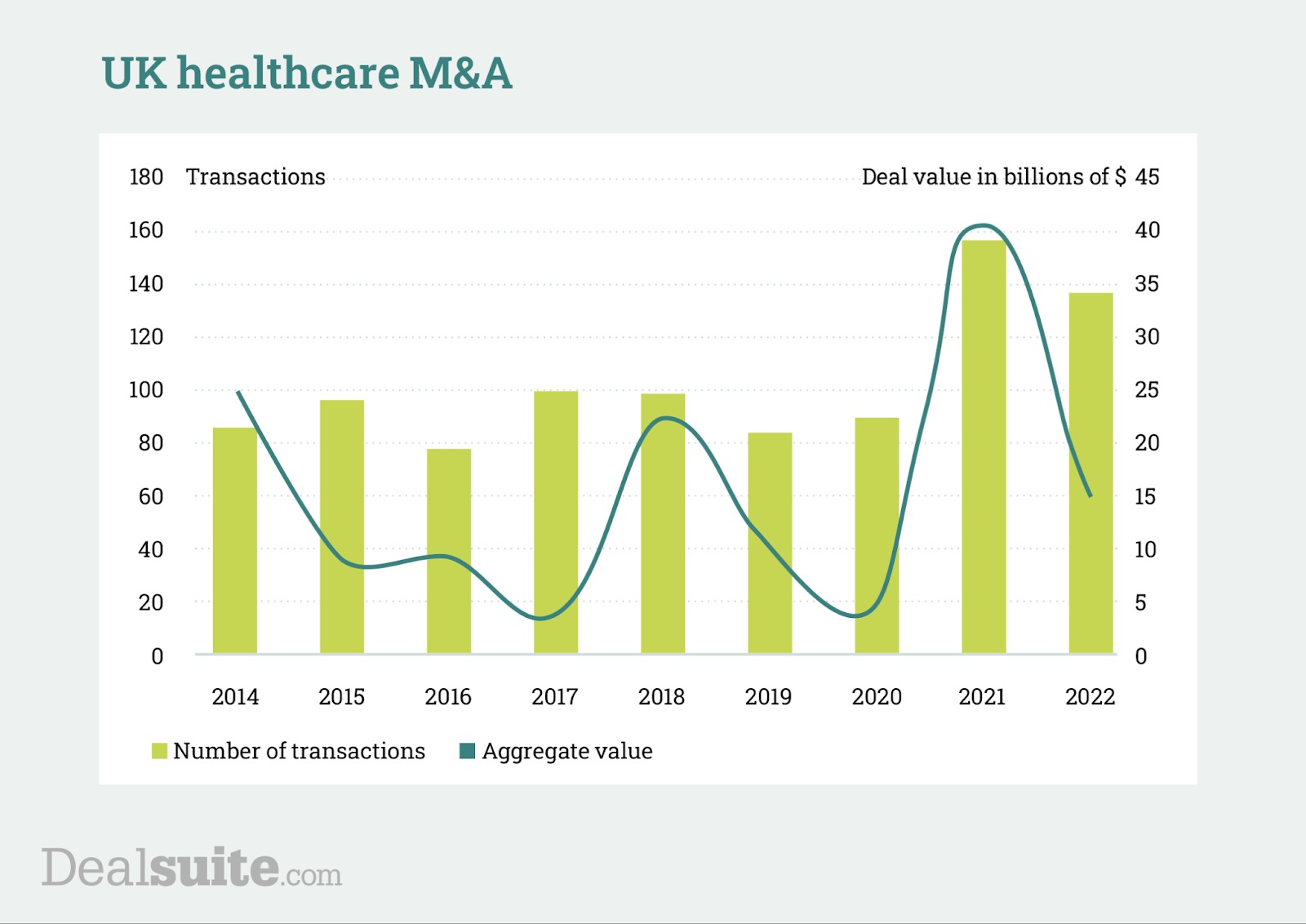

2021 was a big year for M&A in the UK healthcare & life science market. In 2021 alone, the UK pharmaceutical, medical, and biotechnology sectors saw a 75% increase in deal activity compared to 2020.

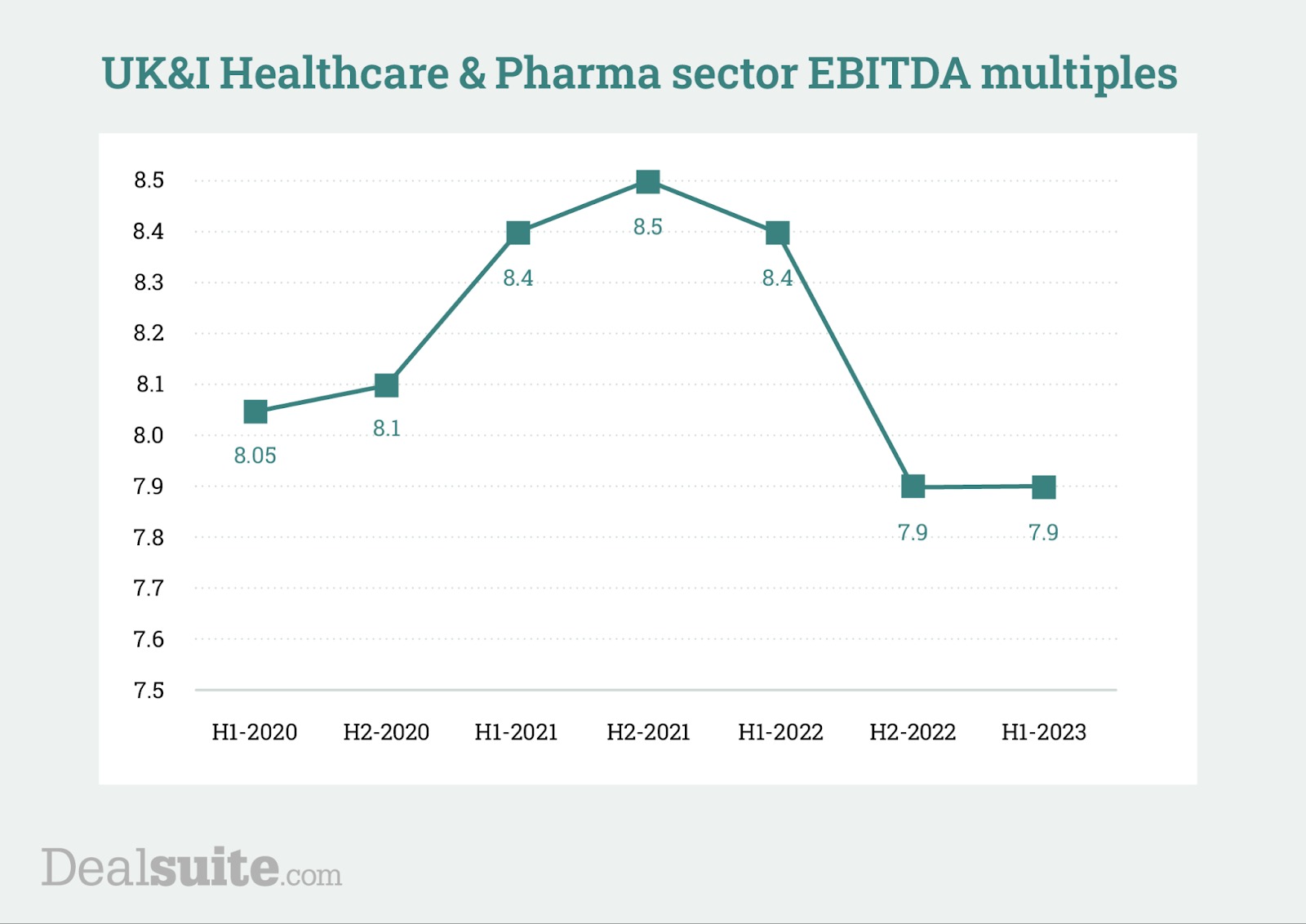

Based on Dealsuite’s biyearly monitors, the same trend can be seen when comparing the number of transactions and aggregate value to the EBITDA-multiples across the years.

Interested in investing in the healthcare sector? With Dealsuite’s smart filtering system you can filter deals based on the industry sector, country and deal type to find the right deal for you.

Book a demo today to find out how Dealsuite can help you find more deals.

.svg)

.svg)

.svg)

.svg)